Honest & Experienced

a trusted name in tax relief

We’ve helped thousands tackle IRS collections & negotiate millions in tax debt. We are honest and straight forward, and

will help map out the best option to get you tax relief. Contact us today for immediate help with your tax issue.

We’ve Been in Business Over 24 Years

A RATING WITH THE BETTER BUSINESS BUREAU

Winner! 2018 Top Ranked on Trustlink

Ranked Best

Tax Resolution Companies on

supermoney

Rated top Tax

Resolution Companies on

best company

We’ve helped thousands of

taxpayers & businesses nationwide

For many, tax debt is by far the most intimidating and confusing financial burden of their lives. We understand this, and for over 15 years our dedicated staff has been the rock many have leaned on for strength and results.

We’ve released thousands of wage garnishments & bank levies

Whether your paycheck is being garnished or your bank account seized, we’ve seen it all.

We’ve successfully resolved MILLIONS of dollars in tax debt

Negotiating tax debt of all sizes is a specialty, and is one that we’ve mastered.

Trusted by thousands of individuals and businesses nationwide

Our reviews and ratings are five star for a reason: because we deliver.

Dedicated to the best customer service in the nation!

Friendly and patient? Check. Knowledgeable and affordable? Check and check.

As seen on:

Our Client

success stories

Personal & Business

tax relief services

Top Rated Tax Relief

Looking To Hire An Expert Tax Relief Attorney For Your Tax Debt Issue? Our Experienced, Affordable Tax Relief Team Has You Covered!

If you owe the IRS or State back taxes, our team of tax professionals and tax relief attorneys will stand by your side and get you tax relief. Having a tax debt in the thousands of dollars is something that has crippled the financial footing of millions of Americans and created needless anxiety. But rest assured, there are incredible, powerful ways you can defend yourself from IRS collections and spiraling penalties and interest, and it starts right now. Our company was formed over 14 years ago to help taxpayers and businesses just like you finally resolve their tax debt and get a fresh start. From stopping wage garnishments and bank levies, to filing old tax returns and negotiating settlements, our firm can take charge of your tax issue and stop your tax debt from spinning any further out of control.Ways our tax relief attorneys & tax professionals can help:

- File old tax returns to get you current and compliant

- Stop IRS wage garnishments and bank levies

- Lift stubborn property and credit tax liens

- End unaffordable penalties and interest

- Negotiate fair and reasonable payment plans

- Represent personal and business audits

- Manage 941 business payroll tax issues

- Defend against aggressive revenue officers

- Represent offshore and foreign bank matters

- Settle personal and business tax debt…and MORE!

Getting Tax Relief Help with your IRS or State Tax Debt

The first step towards successful resolution is to acknowledge that your tax debt and IRS issue won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

File Tax Returns

If you have years of un-filed tax returns, accurately preparing them can dramatically reduce your tax debt!

Every wage earner and business must file a tax return. When you haven’t filed a tax return in more than three years and owe back taxes, the IRS can file criminal charges against you and proceed directly to collection action. While this type of enforcement is rare, it is a pointed reminder that filing tax returns is everyone’s obligation and unreported income will be severely punished. If you have years of un-filed tax returns or IRS back taxes, it’s important to get current. Being timely with your filings is one of the most important and overlooked aspects of tax debt as well as the associated penalties and interest that accrue on back taxes.Our year-over-year preparation services include:

- Individual income tax returns

- Corporation income tax returns

- Partnership income tax returns

- State income tax returns

- FBAR tax returns

- Gift tax returns

When you don’t file your tax return, more often than not you are giving the IRS more money than you need to!

Many taxpayers will accumulate tax debt at an alarming rate when their returns are not filed because the IRS submits the return for them on their behalf, commonly referred to as an SFR (Substitute for Return). This is the worst form of taxation as it allows for zero deductions and maximizes the IRS’s revenue. We have found that the majority of our clients have delinquent returns contributing to their tax debt! This is a common mistake we see all too often. Millions of taxpayers put their heads in the sand when it comes to filing returns or dealing with back taxes, because the process can be complicated and tedious. Taxpayers wrongly assume that if taxes were properly withheld through payroll or claimed through vendors, then filing a return is redundant and unnecessary. This is a very costly mistake, and is one that leads to an estimated billions of dollars annually in tax debt.We can prepare your old tax returns as well as maintain your returns year over year.

Filing your tax return can be one of the best insurance policies against tax debt that you can have. If done correctly, the process is fairly straightforward and easy to maintain year over year. The modest investment to have a professional accurately prepare your returns for you can more than make up for itself in the long run, as it can guard against penalties and interest and create the most favorable tax refund (if any) possible. We have found that many times, when we file a client’s overdue tax returns, we can reduce the amount of assessed tax debt, and in some cases, generate a refund.Get your tax returns filed!

The first step towards successful resolution is to acknowledge that your tax debt and un-filed tax returns won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

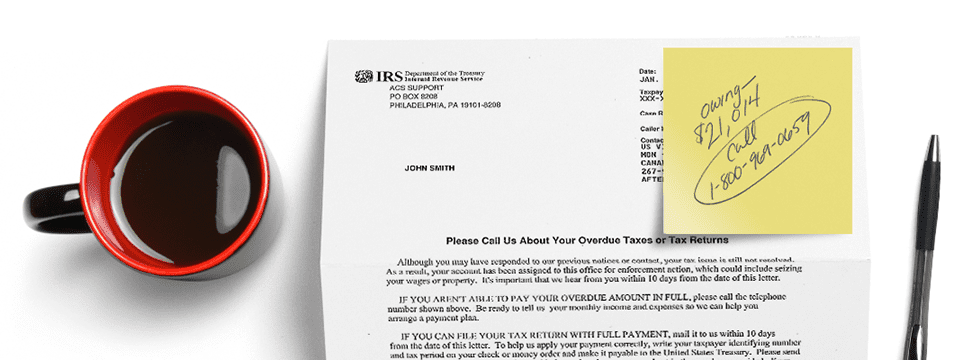

Stop IRS Notices

We can Stop IRS Collection Notices Fast!

If you have a tax debt, you will begin to receive notices in the mail demanding payment. The notices and letters from the IRS will not stop until the tax debt is addressed, and will increase in frequency and severity the longer the debt goes unpaid. If left unpaid, the debt will grow annually through accrued penalties and interest, and collection action will be enforced through a garnishment or asset seizure. We can help intercede and prevent these embarrassing tax letters from coming to your home or business, and we can do this fairly quickly. Once you decide to take advantage of our representation services, we will assume tax power of attorney, and most notices will be directed through our office, freeing your time and your mind. From there we will work to tailor a tax relief program specifically matched to your case and help bring you permanent tax relief.There are three steps before collection action:

- Reminder Notice

- Urgent Notice of Intent to Levy

- Final Notice of Intent to Levy

Reminder Notice

This is the first notice given to individuals and businesses with a tax debt and sets the stage for the collections process. It’s nothing more than a statement of what’s owed for specific years, and depending on the amount of tax debt and years owed, you may receive more than one. They do not come certified mail, so sometimes these notices are lost in transit and are never delivered. Regardless, if you receive a reminder notice stating you have a tax debt, it is very important to save the notice and contact one of our tax relief specialists. Getting professional help is crucial to prevent the tax debt from accruing unnecessary penalties and interest and from further collection action being enforced.Urgent Notice of Intent to Levy

If you’ve received a reminder notice and failed to reply or hire counsel, the IRS will then issue an intent to levy on certain assets. These assets include wages, accounts payable, bank accounts, investment accounts and properties. For the most part, these letters are delivered certified mail and allow thirty days for either the individual or business to respond. If you’ve received an intent to levy notice, it is even more important to get professional help to intercede. If the IRS is not contacted and the tax debt not addressed, income and assets are at tremendous risk of seizure.Final Notice of Intent to Levy

This is the last notice a taxpayer or business will receive before assets are seized to satisfy the tax debt. The notice is sent certified mail and the individual or business has only ten days to respond. If no action is taken, assets will be seized. Wages, bank accounts, equipment, investments, properties, even accounts payable by vendors is attachable. This is the last chance a taxpayer or business is given to cooperate. The IRS has spent time and money pursuing collections for the tax debt that is owed, and if they are not contacted immediately and approached to mediate the debt, the collection process will be enforced. If you have received a final notice of intent to levy, it is imperative that you contact one of our tax relief specialists immediately. We need all the time we can to intercede on your behalf and protect your assets and wages. If you allow too much time to lapse, your assets will be seized. A levy or garnishment is preventable! Do not ignore this last notice. Without addressing your tax debt upon receiving a final notice of levy, not only will wages and assets be attached, but the cost to undo the collection action can be significant.Wage Garnishment or Asset Levy

If you have failed to respond to any of the previously mentioned notices, the last collection effort by the IRS will be enforcement of levy. This means that your employer must remit up to 75% of your income directly to the IRS in the form of a wage garnishment, and your bank accounts can be emptied overnight to satisfy the tax obligation. Levies on businesses can be especially crippling, as cash flow to keep the business operational can be compromised, and accounts payable will be sent notices demanding payment of all outstanding invoices directly to the IRS. To undo this process can be timely, expensive and stressful. For the most part, our staff can release wage garnishments and bank levies within days. We can also intercede swiftly if you’ve had equipment or investment properties and accounts attached. If you’ve been levied or garnished, our tax specialists can help get you quickly back on your feet so that the tax debt can be structured for repayment and/or settlement.Getting Help with IRS Notices

The first step towards successful resolution is to acknowledge that your tax debt and IRS collection notices won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

End Wage Garnishment

Frustrated by an IRS wage garnishment? Get a FULL paycheck and end IRS collections once and for all!

When the IRS or state has failed repeatedly to collect back taxes from individuals, they begin to seize assets. One of the assets that can be attached, and by far considered one of the most crippling, is a wage garnishment. After providing either ten, thirty or sixty day notice through certified mail, the IRS will send a notice to your employer forcing them to withhold up to 75% of your earnings to help satisfy the tax debt.Why you received a wage garnishment:

- The IRS sent a reminder notice.

- The IRS sent several intent to levy notices.

- The IRS sent a final notice of intent to levy.

- The IRS issued a wage garnishment to your employer.

A wage garnishment can be lifted fast!

Remember, a garnishment is designed for one purpose: to get the taxpayer’s attention quickly, and to force them to agree to the IRS’s terms. Often times this means agreeing to a costly payment plan, or waiving their valuable legal rights to get the garnishment lifted. Don’t live another day with a wage garnishment when you don’t have to! Our staff of tax professionals can quickly intercede to come between you and the IRS, to stop wage garnishments and get you back on your feet. When you decide to take advantage of our services, we will immediately contact the taxing authority and negotiate for the release of the wage garnishment on your behalf. From there, we contact your payroll department and inform them once the garnishment is lifted. The process is fast, efficient, and in most cases the wage garnishment can generally be lifted within 7-14 days, plus or minus a few days depending on the circumstances surrounding the garnishment. If you’re suffering from a crippling wage garnishment that is taking up to 75% of what you earn, don’t wait any longer. We can help get you a fresh start.Getting Help with your IRS Wage Garnishment

The first step towards successful resolution is to acknowledge that your tax debt and wage garnishment won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Remove Bank Levy

IRS Levy: The IRS can seize bank accounts, equipment, investment accounts, accounts payable, and attach property! Get these levies lifted FAST!

When the IRS or state has failed repeatedly to collect back taxes from either individuals or businesses, they begin to seize assets. This process comes in two forms: wage garnishments and levies. A wage garnishment attaches a percentage of a taxpayers wages, but an IRS levy attaches an entire asset, such as a bank account or property. IRS levies, especially bank levies, can be incredibly damaging, as they empty accounts overnight and leave the taxpayer or business scrambling.Why you received an IRS levy:

- The IRS sent a reminder notice.

- The IRS sent several notices of intent to levy assets.

- The IRS sent a final notice of intent to levy.

- A Revenue Officer’s (RO) calls went unanswered, or unresolved.

- The IRS and RO issued a bank or asset levy.

An IRS Levy can be reversed quickly!

If you’ve received a bank levy, banks will generally remit the funds to the taxing authority after thirty days, and will only release funds back to your account if the IRS or State advises them to. The IRS or State has issued a bank levy because you have avoided paying your tax obligation. They have sent notices, made phone calls, and have given you ample warning that the next step they will take is to begin seizing assets. Because their letters and demands have been ignored, they have gone into your bank account and taken as much as possible to satisfy the tax debt. So how do you get the IRS or State to reverse these bank levies so that the money taken is replaced? There are many different scenarios for this, but for the most part funds will be reverted back to the taxpayer if they are brought into compliance. Our staff of tax professionals can walk you through your options, helping to get you back on your feet and bank levy free!Getting Help with your IRS Levy

The first step towards successful resolution is to acknowledge that your tax debt and IRS levy won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your IRS levy issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

IRS Payment Plans

Creating an affordable IRS payment plan is one of the most effective strategies to resolve tax debt!

Because of the recent economic downturn, we have found that many people are unable to pay even the minimum required towards their tax debt. When you have a tax debt that you cannot afford to pay, penalties and interest begin to add up quickly, and if left unpaid, forced collection action such as wage garnishments and bank levies will follow. If you are an individual or business with a crushing tax burden, our firm can help you take advantage of an array of IRS payment options that could allow you to repay the debt in time and/or resolve the tax debt altogether.There are 3 repayment options available:

- Full Pay Installment Agreement

- Partial Pay Installment Agreement

- Currently Non-Collectible (CNC)

Full Pay Installment Agreement

This IRS plan structures the entire tax debt to be repaid at the lowest possible monthly amount. Unlike representing yourself where knowledge of tax code and procedure is foreign, we understand the rules and procedures and can enforce them to create the most affordable payment plan that will not default and lead to aggressive collections. That means we work with the assigned IRS revenue agent to negotiate as many allowable expenses as possible, and work to reduce the penalties and associated interest to the lowest amount available. The result is a very fair, affordable installment agreement that allows you to repay the tax debt in time and get back on your feet.Partial Pay Installment Agreement

Though programs such as the Offer in Compromise have received tremendous attention through the media and tax relief firms offering ‘pennies on the dollar’ settlements, often times one of the most dramatic solutions is a partial payment plan, where-in we structure a shortened IRS payment plan that expires long before the tax debt is paid in full. We work with the assigned revenue agent to prove that the taxpayer and/or business cannot possibly repay the tax debt within the active statute of limitations, as well as negotiating the lowest possible penalties and related interest. Qualifying for a Partial Pay Installment Agreement takes work, and is something that not every taxpayer or business will be able to take advantage of. However, the results of a successful partial pay installment agreement can be substantial, saving the qualified taxpayer thousands of dollars on average.Currently Non Collectible (CNC)

If you are experiencing tremendous financial hardship, one of the most dramatic tax relief options is Currently Non Collectible status, where all collection action is frozen against a taxpayer or business. That means the threat to collect back taxes is placed on indefinite hold until the client gets back in their feet, allowing them room and time to breathe. CNC status is a reprieve against collections, but does not eliminate the tax debt. At some point the tax debt may need to be repaid if and when the taxpayer begins earning enough money, and penalties and interest will continue to accrue. However, getting on currently non collectible status can be a very good choice when a financial hardship warrants it.Getting Help with your IRS Payment Plan

The first step towards successful resolution is to acknowledge that your tax debt won’t go away on its own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Lift IRS Lien

A Federal Tax Lien is a PUBLIC notice to your creditors stating that the IRS has a claim to your property.

When the IRS has failed repeatedly to collect an overdue tax debt, they will issue a tax lien on property and assets. This lien places them first in line for payment should the home, property or asset be sold, and can be a tremendous burden to overcome when trying to sell a home. The IRS still has the right to collect even if you acquire property or assets AFTER the lien is filed.IRS tax liens are damaging in a variety of ways:

- They prevent you from selling property.

- They make getting bank loans very difficult.

- Credit is negatively affected.

- They are a public record.

If there is an IRS tax lien on your home or property, you may qualify to have it temporarily lifted to allow you to refinance or sell.

Many taxpayers bought homes and investment properties during the housing boom, and the downturn in property values has many currently looking to refinance to take advantage of historically low lending rates. For those with a tax lien, however, getting low rates and a refinance to go through can be very challenging. Our legal team has worked with many lenders, borrowers and real estate agents to broker a lien subordination with the IRS, where the tax lien is temporarily lifted allowing the transaction to clear without the tax debt being repaid in full. This solution is especially useful when using equity in a property to pay off a negotiated settlement, and can also be a smart option to take advantage of favorable interest rates and market conditions. When you call, a tax relief consultant can help explain this program in greater detail, determining if it’s the right solution for you and your property.Getting Help with your IRS Tax Lien

The first step towards successful resolution is to acknowledge that your tax debt and Federal IRS tax lien won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

IRS Audit Defense

Representing yourself in an IRS audit can cost you thousands of dollars in irreversible penalties!

If you’ve opened a letter informing you that one of your tax returns has been selected for an IRS audit, it’s important to immediately begin assembling your defense. IRS audits can be one of the most challenging and emotionally draining tax issues you will ever face, and if approached incorrectly, the results can be devastating.Ways we can help during IRS audits:

- Negotiate with IRS agent over the position taken on orginal tax return.

- Comprehensive research to dispute audited items.

- Assemble alternative supporting docs to help minimize disputed items.

- Review IRS audit calculation tables for accuracy.

- Communicate directly with the IRS on behalf of taxpayer.

- Represent taxpayer in collections upon audit judgement.

If you’ve been selected for an IRS audit, we can help you stand up to the IRS and get a fair outcome!

When the IRS shows up to the audit, they are familiar with all the laws and regulations allowable, and unless you’ve handled audit proceedings before, you are not. They know this, and will use it to their advantage. Much like trying to represent yourself in court, the outcome is only as good as your representations. We can help put you on equal footing with the IRS to both defend and validate your audited return. Being audited is stressful. We can help you avoid potential pitfalls and position your case for success.Getting Help with your IRS Audit

The first step towards successful resolution is to acknowledge that your tax debt and IRS Audit won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Revenue Officers

If a revenue officer has shown up to your home or business to collect through an asset seizure, we can help!

After the IRS has sent notices demanding payment through the mail and intent to levy notices via certified mail, their next step is to take action. This can be in the form of a wage garnishment or bank levy, but sometimes, depending on the size of the debt, a revenue officer (RO) will be assigned to the case to collect via asset seizure.An IRS Revenue Officer has the authority to:

- Inspect financial accounts

- Levy bank accounts and seize property

- Contact accounts payable and demand direct repayment

- Close businesses and sell the assets

Negotiating directly with a revenue officer can cost you!

We hear it all the time, an RO contacts a taxpayer or business and asks them for financial information, and the taxpayer hands it over. Once the RO determines how much is available for collection, they issue an immediate bank/asset levy or wage garnishment. When asked why they turned over their financials without hiring a professional to intercede, the answer is always the same. “The revenue officer seemed so nice!” Let’s be clear. Just because someone works for the government does not make them a nasty person. In fact, they are now trained to be anything BUT nasty. Most will get much further with a taxpayer by being pleasant than otherwise. If you had a legal issue and had to go to court, would you simply not hire a lawyer because the prosecution seemed agreeable? Of course not. Negotiating with an RO is the same thing. They know your rights, and you don’t. This puts most immediately at a disadvantage. If you have a tax debt, a revenue officer’s job is to collect it, by whatever means necessary. They will make you laugh and smile, but make no mistake. Once your guard is down, they will request revealing and personal financial information, whether it’s bank statements, a profit and loss, balance sheet, or various operating statements. And once they see what you can afford to pay and what your assets are worth, they will begin the process of seizure.The process of asset seizure is avoidable!

A lot of taxpayers wonder if hiring representation will anger the RO and make matters worse. The answer is no. Revenue officers are given certain rights to collect the tax owed, and taxpayers are given certain rights to defend themselves. Much like in a court of law, it’s very important to present your case as favorably as possible. The same can be said with tax debt. It is a huge legal and financial obligation that has lasting consequences. Make sure you leverage your legal rights for a fair and just outcome by hiring a professional to negotiate on your behalf.Getting Help with an IRS Revenue Officer

The first step towards successful resolution is to acknowledge that your tax debt and assigned revenue officer won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Offer in Compromise

A qualified Offer in Compromise (OIC) can be a very effective and dramatic way to settle tax debt!

Most taxpayers have by now heard of the Offer in Compromise, a program drafted by Congress years ago to help eliminate a choking surge of outstanding tax debt. Their assumption was to offer taxpayers a one-time opportunity to eliminate their debt for a fraction of what was originally owed, thus closing millions of costly collection cases.At its core, an Offer in Compromise is a simplified agreement between a taxpayer and the IRS that resolves the taxpayer’s tax debt once and for all. The IRS has the authority to settle, or “compromise,” federal tax liabilities by accepting less than full payment under certain circumstances. The qualified taxpayer can save thousands of dollars, and the IRS, in turn, ends its costly collection process and gets a compliant taxpayer.

SPECIAL UPDATE: IRS Announces Fresh Start Initiative. Qualified Taxpayers Can Now Reduce Amount Owed Up To 75% Lower Than Previously Accepted!

Claims and Expectations Though the Offer in Compromise continues to be an effective tool to dramatically reduce tax liability, and has spawned an entire industry claiming ‘Pennies on the Dollar’ settlements, we would like to clarify what exactly the Offer in Compromise can achieve and what claims should be dismissed.Claim #1: The OIC can settle tax debt for ‘pennies on the dollar’.

True and False. While we find this statement to be grossly misleading, as it implies simplicity to settling outstanding tax debt, the Offer in Compromise can dramatically reduce a taxpayer’s tax liability. In most cases, savings can be in the thousands of dollars and the taxpayer can finally get a fresh start. To qualify for an Offer, however, is very specific, and if not done correctly can cause much more harm than good.Hiring a firm with years of experience and a skilled legal team is very important, as it can help stack the odds for a favorable Offer in Compromise in your favor should you qualify. Some taxpayers may try and save a little money by doing it themselves or hiring an inexpensive service. More often than not the Offer in Compromise is rejected, accepted at a much higher amount than necessary, or even worse, causes increased collection activity such as bank levies and wage garnishments. We’ve prepared thousands of Offers in Compromise, and can help you decide if this option is right for you.

Claim #2: Every taxpayer qualifies for an Offer in Compromise.

False. Although this remains to be one of the more popular advertised tax relief programs, not every taxpayer qualifies to have their tax debt reduced through an Offer in Compromise. In fact, the percentage of qualifying taxpayers is relatively low. Getting approved is a very specific process, and is one that must be approached carefully.

While our firm has drafted thousands of qualifying Offer in Compromise’s, our experience pays off when we can find a more impactful means of mediation when a client does not qualify.

Claim #3: All firms offer the same Offer in Compromise service.

False. To accurately prepare an effective Offer in Compromise takes time and experience. There is simply no getting around the work that must be done to accurately draft a substantial offer. As you would more than likely hire a seasoned attorney to represent you in court for a criminal matter as opposed to a first year law student, the same can be said of the experience needed towards your tax obligation. The upfront fee is fair, and the savings and results can be dramatic for the qualifying taxpayer.

Besides the OIC, there are other popular settlement options:

- Penalty abatement, which removes penalties from accrued liabilities.

- Partial payment plans, which expire before the tax debt is paid in full.

- CNC status, where IRS collections are placed on indefinite hold.

Tax debt is, for most, the largest financial burden of their lives. Investing in a tax relief firm with years of experience and a dedication towards impeccable customer service is one of the best investments you can make. The process of drafting an Offer in Compromise is lengthy and complex, and is one that takes a staff of seasoned professionals and a fair fee to accurately address.

Getting Help with your IRS Tax Settlement

The first step towards successful resolution is to acknowledge that your tax debt won’t go away on its own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Penalties & Interest

IRS penalties and interest increase your tax debt every day, just like a credit card. Take back control today!

When you accrue a tax debt, the IRS will begin to add both penalties and interest to the principal. The IRS penalties and interest are compounded at alarming rates, just like high interest credit cards, and can quickly double, triple, even quadruple your tax debt. If left unpaid, the IRS debt will simply grow and grow until the options are suffocating.Facts about IRS Penalties:

- IRS penalties & interest are the majority of most tax liabilities

- The IRS interest rate is the federal lending rate plus 3%

- Penalties are up to 5% a month, and grow continually until repaid

- Combined, IRS penalties & interest can dwarf most credit card rates

Save money with a qualified IRS penalty abatement.

You don’t have to keep paying high IRS interest and penalties on your tax debt and worry about the threat of forced collections. There is another way. When you hire us to represent your tax relief issue, we can approach the taxing authorities and request an abatement on penalties and associated interest. This means spiraling IRS penalties and interest are controlled and the threat of forced collections is quelled. However, the terms for a successful penalty abatement are very specific. More so than any other, this program involves a great deal of skill to successfully navigate the IRS protocol and bring resolution. If applied for correctly and effectively, results are substantial; savings are usually in the thousands of dollars for the average taxpayer. Our staff of tax professionals has years of experience preparing penalty abatements, and can help stop the penalties and interest from accumulating.Getting Help Controlling IRS Penalties!

The first step towards successful resolution is to acknowledge that your tax debt and associated penalties and interest won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

State Tax Debt

Because of the recent economic downturn, state tax collection agencies are more aggressive than ever!

Many people who have an IRS tax debt more than likely have a state tax debt as well. Because states don’t have the resources of the federal government, they are more reliant on timely year-over-year tax payments to operate. When either an individual or business falls behind on their state tax obligations, the efforts to recover the debt are swift and aggressive. State collection agencies use threats, levies, garnishments, and seizures on a much broader scale than the IRS, and the revenue officers assigned to enforce collections can be ruthless. Bank accounts can be emptied overnight, and businesses and assets sold to satisfy the obligation. Now, more than ever, state tax debt is one of the most financially destructive obligations a taxpayer can accrue.States and the IRS offer similar programs to help resolve tax debt!

Though the efforts to collect state back taxes can be severe, both individuals and businesses have legal, enforceable rights to stop collections and settle tax debt. While state collection tactics may be more aggressive, they are nonetheless bound by tax law to offer relief to those who qualify. Most states offer similar versions of the Offer in Compromise program, and will negotiate repayment plans and amnesty from penalties and interest if successfully approached and mediated.Getting Help with State Tax Debt

The first step towards successful resolution is to acknowledge that your state tax debt won’t go away on its own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

941 Business Tax

If you have a 941 business payroll tax debt, assets can be seized and the business closed to pay off the liability!

If you own or have owned a business with employees, the IRS assesses what is termed 941-employee business payroll withholding tax. This payroll tax is due at the end of every pay period and/or operating quarter, and if it is not paid, penalties and interest will begin to accrue. If this payroll tax debt is neglected long enough, the business can be closed and all assets seized to satisfy the IRS debt. 941 business payroll withholding tax debt is widely considered to be the worst form of tax debt as the IRS considers it “stealing” directly from the government. Though the IRS is extremely aggressive collecting business payroll tax, businesses have very specific, enforceable rights that they are entitled to, and if enforced effectively, can help stave off collections and save the business.941 Business Payroll tax debt can be resolved fairly!

Depending on the variables of the case, the business payroll taxes themselves can often times qualify for a settlement proposal, and the associated penalties successfully abated. Upon assuming power of attorney, our firm can request a reprieve against collections, buying time for the business to map out the most affordable repayment plan without suffocating operating costs. Trying to tackle business payroll tax debt on your own and negotiate directly with the assigned revenue officer is strongly advised against! The IRS knows that with businesses, more so than individual tax debt, there are assets available to help pay off the 941 withholding tax debt, and the road to resolution can be complicated and hazardous. As a business owner, the modest investment towards legal representation must be accepted, much like it is towards bookkeeping and inventory, to minimize risk and maximize results.Getting Help with your 941 Business Payroll Tax Debt

The first step towards successful tax resolution is to acknowledge that your tax debt and 941 business payroll tax issue won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your payroll tax debt free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Offshore Banking

Avoid Penalties & Prosecution. Disclose Offshore Foreign Banking w/OVDP (formerly OVDI) and Get Compliant Today!

Hoping to repeat the success of the 2009 and 2011 Offshore Voluntary Disclosure Initiatives (OVDI) that has raised nearly $4.4 billion and counting in new tax revenue, on Jan 9th, 2012 the IRS announced a new OVDP – Offshore Voluntary Disclosure Program – with as-of-yet no expiration date. Like the 30,000 offshore account owners who came forward under the first two initiatives, those seeking leniency won’t get IRS approval if federal investigators have already started probing the applicants’ accounts. And like the earlier programs, those approved won’t face criminal prosecution. Because this 2012 OVDP can potentially be recalled at any time, we encourage those with overseas income and unreported assets to get represented immediately!Report Your Foreign Banking Now with Voluntary Disclosure!

By coming forward, those with offshore bank accounts can help protect their assets and guard themselves against both criminal prosecution and inflamed penalties that could eat up the majority of their offshore accounts. The IRS has made collection of hidden bank accounts a top priority, and have made coming forward a requirement for anyone with offshore accounts exceeding $10,000.Terms of the 2012 OVDP (formerly OVDI) include:

- A 27.5% penalty on the amount in the offshore accounts in the year from 2003 to 2011 with the highest aggregate balance. That’s up from 25% under the earlier 2011 program, which also covered only a six-year period. Participants must also pay back-taxes and interest for up to eight years, plus accuracy and delinquency penalties.

- A lower, 12.5% penalty for those whose previously secret accounts did not hold more than $75,000 for any year from 2003 to 2011. And an even lower 5% penalty limited to special circumstances, such as those who inherited offshore accounts and had little involvement with them.

Ways we can help with OVDP (offshore voluntary disclosure program)

- Criminal tax representation.

- FBAR Compliance and Voluntary Disclosure.

- Preparation of all forms required by the Offshore Voluntary Disclosure Initiative.

- Original or amended income tax returns.

- Offshore Voluntary Disclosures Letters.

- Form 433-A, Collection Information Statement for Wage Earners and Self-employed Individuals, or Form 433-B, Collection Information Statement for Businesses, as appropriate.

- Foreign Account or Asset Statements.

- Penalty computation worksheet showing the applicant’s determination of the aggregate highest account balance of his/her undisclosed offshore accounts, fair market value of foreign assets, and penalty computation.

- Agreements to extend the period of time to assess tax (including tax penalties) and to assess FBAR penalties.

- Form TD F 90.22-1, Report of Foreign Bank and Financial Accounts, for foreign accounts maintained during calendar years covered by the voluntary disclosure.

- A statement identifying all offshore entities for the tax years covered by the voluntary disclosure, whether held directly or indirectly, and your ownership or control share of such entities.

- Forms 3520, 3520-A, 5471, 5472, 926 and 8865 for all tax years covered by the voluntary disclosure.

- Amended estate or gift tax returns (original estate or gift tax returns, if not previously filed) for tax years covered by the voluntary disclosure necessary to correct the under reporting of assets held in or transferred through undisclosed foreign accounts or foreign entities.

- A statement whether the amended returns involve PFIC issues during the tax years covered by the 2011 OVDI period.

- Ordering of copies of offshore financial account statements reflecting all account activity for each of the tax years covered by your voluntary disclosure. Provide an explanation of any differences between the amounts reported on the account statements and the tax returns.

- Negotiations with the Revenue Agent once the case is accepted into the Voluntary Disclosure Initiative for the lowest penalty possible.

- Negotiations with the IRS on the assessed offshore penalty. Preparation of the tax resolution, such as an Offer-in-Compromise, Installment Agreement, Partial Pay Installment Agreement, etc.

FBAR Background

The original FBAR created the Bank Secrecy Act, which gave the Department of Treasury authority to establish record keeping and filing requirements for U.S. persons with financial interests in or signature authority or other authority over financial accounts maintained with financial institutions in foreign countries. This provision of the law requires that a Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts (FBAR), be filed if the aggregate balances of such foreign accounts exceed $10,000 at any time during the year. This form is used as part of the IRS’ enforcement initiative against abusive offshore transactions and attempts by U.S. persons to avoid taxes by hiding money offshore. This includes any interest a US person has in:- Offshore bank accounts

- Offshore mutual funds

- Offshore hedge funds

- Offshore variable universal life insurance policies

- Offshore variable annuities a/k/a Swiss Annuities

- Debit card and prepaid credit card offshore accounts

FATCA – Foreign Account Tax Compliance Act

The provisions commonly known as the Foreign Account Tax Compliance Act (FATCA) became law in March 2010. Per the IRS guidelines:- FATCA targets tax non-compliance by U.S. taxpayers with foreign accounts

- U.S. individual taxpayers must report information about certain foreign financial accounts and offshore assets on Form 8938 and attach it to their income tax return, if the total asset value exceeds the appropriate reporting threshold. Form 8938 reporting is in addition to FBAR reporting.

- To avoid being withheld upon, a foreign financial institution may register with the IRS, obtain a Global Intermediary Identification Number (GIIN) and report certain information on U.S. accounts to the IRS.

Getting Help with your Offshore Foreign Banking Issue/FBAR/OVDI/FATCA

The first step towards successful resolution is to acknowledge that your tax debt and offshore banking issue won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

High Dollar Unit

Our tax relief attorneys will step up and step in to handle your multi-million dollar tax debt quickly and affordably!

Our clients come from all walks of life, and sometimes they incur massive tax liabilities that seemed to start small but grew year after year into the seven figures. If you own a business with a tax burden in the seven figures, or are an individual filer whose tax debt has spun out of control and owe in the millions, our staff of experienced professionals is well equipped to negotiate on your behalf and protect your assets from IRS or State collections and seizure.We are one of the only firms in the nation with a division dedicated exclusively towards these high dollar unit cases!

Take action now to protect your assets and income!

When you owe a tax liability this high, your account is assigned to a special IRS collection unit called the ‘High Dollar Unit’. This division of the IRS is dedicated towards the collection of higher profile tax evaders and debtors, and have at their disposal every means necessary to bring that taxpayer or business compliant. That means your assets and bank accounts are in IMMEDIATE danger, and can be seized to pay off the liability. We’ve helped protect thousands of taxpayers and businesses from asset seizure and have negotiated millions in tax debt over the years. So whether your tax debt is in the low or high seven figures, our staff will intercede with immediate action to protect your interests, negotiate a fair outcome, and establish reasonable payment terms on the balance.Get your High Dollar Unit case mediated Fast!

The first step towards successful resolution is to acknowledge that your million dollar plus tax debt won’t go away on it’s own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Innocent Spouse

Love and Marriage May Bring Tax Trouble. Know Your Options.

After you say "I Do," give that sweet kiss, and come back from the honeymoon, you and your spouse will have a whole lifetime together to make money, spend money, and unwillingly give money to the IRS. But sometimes while love and marriage may bring blissful joy, it can also bring tax trouble if your spouse isn't completely honest with you about finances. That's because married couples filing joint tax returns are each liable for all taxes owed, even if one spouse engaged in tax evasion or used questionable tax deductions. There are options for spouses who are wronged by – and filed joint tax returns with – a shady spouse. The IRS has procedures innocent spouses can pursue, and which one to pursue depends on your situation.Innocent Spouse Relief

First off, there's what's called Innocent Spouse Relief. It'll relieve you of having to pay additional taxes if your spouse or former spouse engaged in tax evasion (didn't report all of his or her income), claimed questionable tax credits or deductions, or improperly reported income. To qualify for Innocent Spouse Relief, you have to have filed a joint tax return with your spouse or ex-spouse that has a tax deficiency solely due to your spouse. It'll also have to be considered "unfair" to hold you liable for the tax, and you'll have to be able to show that when you signed the joint tax return you had no way of knowing that there was a tax deficiency. The second type of relief that can be sought by wronged spouses is Separation of Liability Relief.Separation of Liability Relief

Separation of Liability Relief allocates additional tax owed between you and your spouse or ex-spouse and makes you liable only for the amount you're allocated. The additional tax has to be due to a misreported item on a joint return that you helped file. This type of relief also has a few requirements. You'll have to have filed a joint return, and be either divorced from the other person on the joint return, widowed, or not have been a member of the same household as the other person on the joint tax return for at least a year. Innocent Spouse Relief and Separation of Liability Relief both have the same requirement: either of these types of relief have to be applied for within two years from the IRS's first attempt to get you to pay the tax. But if you're in trouble with the tax man because of your current or former spouse, you may be able to pursue what's called Equitable Relief.Equitable Relief

Equitable Relief is an option when you don't qualify for both of the other options mentioned above. The tax problem must relate to a misreported item on a joint tax return, and that misreported item will have to be due to your spouse. A wronged taxpayer spouse can also qualify for Equitable Relief if the taxes were calculated correctly, but it wasn't paid along with the tax return. But here's the main kicker for qualifying for Equitable Relief: you'll have to show that given the entire situation, it's unfair to make you liable for the tax deficiency. If the situation is that bad, it shouldn't be hard to show.Getting Help for Innocent Spouse

While being married can be fun, getting hit with a tax bill because of a shady spouse isn't. If that sounds like you, drop us a line so we can help you pursue the right kind of relief. Our tax professionals have spent years getting to know the ins and outs of this program, and can help navigate you to safety, and sometimes, big savings!Top Rated Tax Relief

Looking To Hire An Expert Tax Relief Attorney For Your Tax Debt Issue? Our Experienced, Affordable Tax Relief Team Has You Covered!

If you owe the IRS or State back taxes, our team of tax professionals and tax relief attorneys will stand by your side and get you tax relief. Having a tax debt in the thousands of dollars is something that has crippled the financial footing of millions of Americans and created needless anxiety. But rest assured, there are incredible, powerful ways you can defend yourself from IRS collections and spiraling penalties and interest, and it starts right now. Our company was formed over 14 years ago to help taxpayers and businesses just like you finally resolve their tax debt and get a fresh start. From stopping wage garnishments and bank levies, to filing old tax returns and negotiating settlements, our firm can take charge of your tax issue and stop your tax debt from spinning any further out of control.Ways our tax relief attorneys & tax professionals can help:

- File old tax returns to get you current and compliant

- Stop IRS wage garnishments and bank levies

- Lift stubborn property and credit tax liens

- End unaffordable penalties and interest

- Negotiate fair and reasonable payment plans

- Represent personal and business audits

- Manage 941 business payroll tax issues

- Defend against aggressive revenue officers

- Represent offshore and foreign bank matters

- Settle personal and business tax debt…and MORE!

Getting Tax Relief Help with your IRS or State Tax Debt

The first step towards successful resolution is to acknowledge that your tax debt and IRS issue won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

File Tax Returns

If you have years of un-filed tax returns, accurately preparing them can dramatically reduce your tax debt!

Every wage earner and business must file a tax return. When you haven’t filed a tax return in more than three years and owe back taxes, the IRS can file criminal charges against you and proceed directly to collection action. While this type of enforcement is rare, it is a pointed reminder that filing tax returns is everyone’s obligation and unreported income will be severely punished. If you have years of un-filed tax returns or IRS back taxes, it’s important to get current. Being timely with your filings is one of the most important and overlooked aspects of tax debt as well as the associated penalties and interest that accrue on back taxes.Our year-over-year preparation services include:

- Individual income tax returns

- Corporation income tax returns

- Partnership income tax returns

- State income tax returns

- FBAR tax returns

- Gift tax returns

When you don’t file your tax return, more often than not you are giving the IRS more money than you need to!

Many taxpayers will accumulate tax debt at an alarming rate when their returns are not filed because the IRS submits the return for them on their behalf, commonly referred to as an SFR (Substitute for Return). This is the worst form of taxation as it allows for zero deductions and maximizes the IRS’s revenue. We have found that the majority of our clients have delinquent returns contributing to their tax debt! This is a common mistake we see all too often. Millions of taxpayers put their heads in the sand when it comes to filing returns or dealing with back taxes, because the process can be complicated and tedious. Taxpayers wrongly assume that if taxes were properly withheld through payroll or claimed through vendors, then filing a return is redundant and unnecessary. This is a very costly mistake, and is one that leads to an estimated billions of dollars annually in tax debt.We can prepare your old tax returns as well as maintain your returns year over year.

Filing your tax return can be one of the best insurance policies against tax debt that you can have. If done correctly, the process is fairly straightforward and easy to maintain year over year. The modest investment to have a professional accurately prepare your returns for you can more than make up for itself in the long run, as it can guard against penalties and interest and create the most favorable tax refund (if any) possible. We have found that many times, when we file a client’s overdue tax returns, we can reduce the amount of assessed tax debt, and in some cases, generate a refund.Get your tax returns filed!

The first step towards successful resolution is to acknowledge that your tax debt and un-filed tax returns won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Stop IRS Notices

We can Stop IRS Collection Notices Fast!

If you have a tax debt, you will begin to receive notices in the mail demanding payment. The notices and letters from the IRS will not stop until the tax debt is addressed, and will increase in frequency and severity the longer the debt goes unpaid. If left unpaid, the debt will grow annually through accrued penalties and interest, and collection action will be enforced through a garnishment or asset seizure. We can help intercede and prevent these embarrassing tax letters from coming to your home or business, and we can do this fairly quickly. Once you decide to take advantage of our representation services, we will assume tax power of attorney, and most notices will be directed through our office, freeing your time and your mind. From there we will work to tailor a tax relief program specifically matched to your case and help bring you permanent tax relief.There are three steps before collection action:

- Reminder Notice

- Urgent Notice of Intent to Levy

- Final Notice of Intent to Levy

Reminder Notice

This is the first notice given to individuals and businesses with a tax debt and sets the stage for the collections process. It’s nothing more than a statement of what’s owed for specific years, and depending on the amount of tax debt and years owed, you may receive more than one. They do not come certified mail, so sometimes these notices are lost in transit and are never delivered. Regardless, if you receive a reminder notice stating you have a tax debt, it is very important to save the notice and contact one of our tax relief specialists. Getting professional help is crucial to prevent the tax debt from accruing unnecessary penalties and interest and from further collection action being enforced.Urgent Notice of Intent to Levy

If you’ve received a reminder notice and failed to reply or hire counsel, the IRS will then issue an intent to levy on certain assets. These assets include wages, accounts payable, bank accounts, investment accounts and properties. For the most part, these letters are delivered certified mail and allow thirty days for either the individual or business to respond. If you’ve received an intent to levy notice, it is even more important to get professional help to intercede. If the IRS is not contacted and the tax debt not addressed, income and assets are at tremendous risk of seizure.Final Notice of Intent to Levy

This is the last notice a taxpayer or business will receive before assets are seized to satisfy the tax debt. The notice is sent certified mail and the individual or business has only ten days to respond. If no action is taken, assets will be seized. Wages, bank accounts, equipment, investments, properties, even accounts payable by vendors is attachable. This is the last chance a taxpayer or business is given to cooperate. The IRS has spent time and money pursuing collections for the tax debt that is owed, and if they are not contacted immediately and approached to mediate the debt, the collection process will be enforced. If you have received a final notice of intent to levy, it is imperative that you contact one of our tax relief specialists immediately. We need all the time we can to intercede on your behalf and protect your assets and wages. If you allow too much time to lapse, your assets will be seized. A levy or garnishment is preventable! Do not ignore this last notice. Without addressing your tax debt upon receiving a final notice of levy, not only will wages and assets be attached, but the cost to undo the collection action can be significant.Wage Garnishment or Asset Levy

If you have failed to respond to any of the previously mentioned notices, the last collection effort by the IRS will be enforcement of levy. This means that your employer must remit up to 75% of your income directly to the IRS in the form of a wage garnishment, and your bank accounts can be emptied overnight to satisfy the tax obligation. Levies on businesses can be especially crippling, as cash flow to keep the business operational can be compromised, and accounts payable will be sent notices demanding payment of all outstanding invoices directly to the IRS. To undo this process can be timely, expensive and stressful. For the most part, our staff can release wage garnishments and bank levies within days. We can also intercede swiftly if you’ve had equipment or investment properties and accounts attached. If you’ve been levied or garnished, our tax specialists can help get you quickly back on your feet so that the tax debt can be structured for repayment and/or settlement.Getting Help with IRS Notices

The first step towards successful resolution is to acknowledge that your tax debt and IRS collection notices won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

End Wage Garnishment

Frustrated by an IRS wage garnishment? Get a FULL paycheck and end IRS collections once and for all!

When the IRS or state has failed repeatedly to collect back taxes from individuals, they begin to seize assets. One of the assets that can be attached, and by far considered one of the most crippling, is a wage garnishment. After providing either ten, thirty or sixty day notice through certified mail, the IRS will send a notice to your employer forcing them to withhold up to 75% of your earnings to help satisfy the tax debt.Why you received a wage garnishment:

- The IRS sent a reminder notice.

- The IRS sent several intent to levy notices.

- The IRS sent a final notice of intent to levy.

- The IRS issued a wage garnishment to your employer.

A wage garnishment can be lifted fast!

Remember, a garnishment is designed for one purpose: to get the taxpayer’s attention quickly, and to force them to agree to the IRS’s terms. Often times this means agreeing to a costly payment plan, or waiving their valuable legal rights to get the garnishment lifted. Don’t live another day with a wage garnishment when you don’t have to! Our staff of tax professionals can quickly intercede to come between you and the IRS, to stop wage garnishments and get you back on your feet. When you decide to take advantage of our services, we will immediately contact the taxing authority and negotiate for the release of the wage garnishment on your behalf. From there, we contact your payroll department and inform them once the garnishment is lifted. The process is fast, efficient, and in most cases the wage garnishment can generally be lifted within 7-14 days, plus or minus a few days depending on the circumstances surrounding the garnishment. If you’re suffering from a crippling wage garnishment that is taking up to 75% of what you earn, don’t wait any longer. We can help get you a fresh start.Getting Help with your IRS Wage Garnishment

The first step towards successful resolution is to acknowledge that your tax debt and wage garnishment won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Remove Bank Levy

IRS Levy: The IRS can seize bank accounts, equipment, investment accounts, accounts payable, and attach property! Get these levies lifted FAST!

When the IRS or state has failed repeatedly to collect back taxes from either individuals or businesses, they begin to seize assets. This process comes in two forms: wage garnishments and levies. A wage garnishment attaches a percentage of a taxpayers wages, but an IRS levy attaches an entire asset, such as a bank account or property. IRS levies, especially bank levies, can be incredibly damaging, as they empty accounts overnight and leave the taxpayer or business scrambling.Why you received an IRS levy:

- The IRS sent a reminder notice.

- The IRS sent several notices of intent to levy assets.

- The IRS sent a final notice of intent to levy.

- A Revenue Officer’s (RO) calls went unanswered, or unresolved.

- The IRS and RO issued a bank or asset levy.

An IRS Levy can be reversed quickly!

If you’ve received a bank levy, banks will generally remit the funds to the taxing authority after thirty days, and will only release funds back to your account if the IRS or State advises them to. The IRS or State has issued a bank levy because you have avoided paying your tax obligation. They have sent notices, made phone calls, and have given you ample warning that the next step they will take is to begin seizing assets. Because their letters and demands have been ignored, they have gone into your bank account and taken as much as possible to satisfy the tax debt. So how do you get the IRS or State to reverse these bank levies so that the money taken is replaced? There are many different scenarios for this, but for the most part funds will be reverted back to the taxpayer if they are brought into compliance. Our staff of tax professionals can walk you through your options, helping to get you back on your feet and bank levy free!Getting Help with your IRS Levy

The first step towards successful resolution is to acknowledge that your tax debt and IRS levy won’t go away on their own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your IRS levy issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

IRS Payment Plans

Creating an affordable IRS payment plan is one of the most effective strategies to resolve tax debt!

Because of the recent economic downturn, we have found that many people are unable to pay even the minimum required towards their tax debt. When you have a tax debt that you cannot afford to pay, penalties and interest begin to add up quickly, and if left unpaid, forced collection action such as wage garnishments and bank levies will follow. If you are an individual or business with a crushing tax burden, our firm can help you take advantage of an array of IRS payment options that could allow you to repay the debt in time and/or resolve the tax debt altogether.There are 3 repayment options available:

- Full Pay Installment Agreement

- Partial Pay Installment Agreement

- Currently Non-Collectible (CNC)

Full Pay Installment Agreement

This IRS plan structures the entire tax debt to be repaid at the lowest possible monthly amount. Unlike representing yourself where knowledge of tax code and procedure is foreign, we understand the rules and procedures and can enforce them to create the most affordable payment plan that will not default and lead to aggressive collections. That means we work with the assigned IRS revenue agent to negotiate as many allowable expenses as possible, and work to reduce the penalties and associated interest to the lowest amount available. The result is a very fair, affordable installment agreement that allows you to repay the tax debt in time and get back on your feet.Partial Pay Installment Agreement

Though programs such as the Offer in Compromise have received tremendous attention through the media and tax relief firms offering ‘pennies on the dollar’ settlements, often times one of the most dramatic solutions is a partial payment plan, where-in we structure a shortened IRS payment plan that expires long before the tax debt is paid in full. We work with the assigned revenue agent to prove that the taxpayer and/or business cannot possibly repay the tax debt within the active statute of limitations, as well as negotiating the lowest possible penalties and related interest. Qualifying for a Partial Pay Installment Agreement takes work, and is something that not every taxpayer or business will be able to take advantage of. However, the results of a successful partial pay installment agreement can be substantial, saving the qualified taxpayer thousands of dollars on average.Currently Non Collectible (CNC)

If you are experiencing tremendous financial hardship, one of the most dramatic tax relief options is Currently Non Collectible status, where all collection action is frozen against a taxpayer or business. That means the threat to collect back taxes is placed on indefinite hold until the client gets back in their feet, allowing them room and time to breathe. CNC status is a reprieve against collections, but does not eliminate the tax debt. At some point the tax debt may need to be repaid if and when the taxpayer begins earning enough money, and penalties and interest will continue to accrue. However, getting on currently non collectible status can be a very good choice when a financial hardship warrants it.Getting Help with your IRS Payment Plan

The first step towards successful resolution is to acknowledge that your tax debt won’t go away on its own and to seek professional assistance. Our firm of tax relief attorneys and tax relief professionals has helped thousands of individuals and businesses just like you stop forced collections and finally resolve their tax debt.Our tax relief professionals will take the time to discuss your issue free of charge, and help map out the best solution moving forward. Rest assured, all information is confidential, and nothing will be shared. We understand that you have many options when it comes to choosing the right tax relief firm, and we welcome the opportunity to help you patiently through this process and bring closure to this important financial consideration.

Lift IRS Lien

A Federal Tax Lien is a PUBLIC notice to your creditors stating that the IRS has a claim to your property.

When the IRS has failed repeatedly to collect an overdue tax debt, they will issue a tax lien on property and assets. This lien places them first in line for payment should the home, property or asset be sold, and can be a tremendous burden to overcome when trying to sell a home. The IRS still has the right to collect even if you acquire property or assets AFTER the lien is filed.IRS tax liens are damaging in a variety of ways:

- They prevent you from selling property.

- They make getting bank loans very difficult.

- Credit is negatively affected.

- They are a public record.

If there is an IRS tax lien on your home or property, you may qualify to have it temporarily lifted to allow you to refinance or sell.