We can help you file your

Personal tax returns

It’s true. We love tax returns.

Don’t worry, we got the memo: doing your tax returns probably isn’t the one thing you’re super jazzed about year in and year out. In fact, most people dislike it so much they hire the first tax preparer they meet or are referred to, and only change when something goes terribly wrong. Well, there’s a better, simpler, and more affordable way to do things.

Nice to e-meet you. We’re the better way to do your taxes. In fact, we’re a whole new category of tax preparation service. We offer service competitive to the best firms out there at a fraction of the cost, with super personal service and options way above your average tax return mill

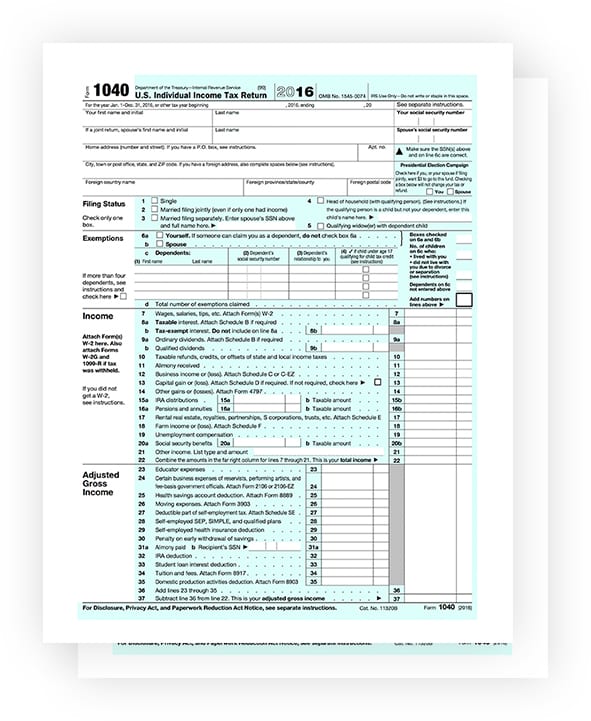

Federal Tax Returns

We file your Federal returns with the IRS each year, along with reporting for all 50 States.

Specialty Returns

We handle and prepare specialty returns such as Trusts, Estates, and Gift Taxes.

FBAR Returns

For individuals with more than ten thousand dollars in unreported foreign bank accounts, we file FBAR returns to get you current and penalty free.

Preparing un-filed returns can

dramatically reduce your debt!

Every wage earner must file a tax return. When you haven’t filed a tax return in more than three years and owe back taxes, the IRS can file criminal charges against you and proceed directly to collection action. While this type of enforcement is rare, it is a pointed reminder that filing tax returns is everyone’s obligation and unreported income will be severely punished.

Filing your tax return can be one of the best insurance policies against tax debt that you can have. The modest investment to have a professional accurately prepare your returns for you can more than make up for itself in the long run, as it can guard against penalties and interest and create the most favorable tax refund (if any) possible. When we file a client’s overdue tax returns, we can generally reduce the amount of assessed tax debt, and in some cases, generate a refund.

We can maintain your returns

year over year

Getting your expenses itemized, your books in line, and your returns filed each and every year is a frustration many look to avoid altogether. And while filing your returns isn’t like rounding the bases after a perfectly hit pitch, it’s very important to get done right and on-time to avoid costly penalties and overpayment. Our team of tax preparers has spent years mastering the nuances of tax representation, so unless you love talking tax, don’t expect intimidating talks about new codes and dire forecasts. We know to keep it short and sweet. Once a simple on-boarding process is complete, we’re off to the races. Each year your returns will be on-time, error-free, and maximized for refunds.

Free eBook

Important IRS Deadlines

Besides April 15th, there are many other important IRS deadlines and dates that you need to know. Make sure and stay on top of all your personal and business filing dates and avoid needless penalties and interest with this valuable ebook.

Answers to questions

about personal returns

-

Foreclosure or debt written off?

+If you had a recent Foreclosure, short sale, credit card debt write-off or any other cancellation of debt, we can help you exclude part or all of that income.

-

Missing W-2’s, 1099’s or other docs?

+We can obtain all of those and most other taxing documents you would need to file any previous year’s returns.

-

Executor of an estate?

+If someone has passed away and left you in charge of their assets and finances, we can help guide you through your responsibilities, including all filing and reporting of any distributions.

-

Don’t have all of your records ready?

+If you need more time to get your returns in order, rest easy. We file extensions too.