Free Ebooks

We’ve provided a lot of useful information on our site, but for a deeper understanding of the tax relief process, we’ve provided several e-books to help better educate you.

Irs Forms

Looking for the right IRS form? Two of the most powerful tools we use in the fight against tax debt are the 8821 and 2848 forms. Learn more about them below.

Tax Preparation

Providing a comprehensive learning section of articles, downloads, forms and tips, get up to the minute insight into mastering your personal or business returns.

Free eBooks

from our help desk to yours

We’ve provided a lot of useful information on our site, but for a deeper understanding of the tax relief process, we’ve provided several brochures to help better educate you, topic by topic. This list of tax tips will expand often, so check back for new guides and downloads. And if you have a suggestion for a topic, email us!

Tax Settlement Options

There are countless ways to resolve and settle outstanding tax debt. Get to know some of the more popular programs available to taxpayers and businesses in this enlightening download.

Important IRS Deadlines

Besides April 15th, there are many other important IRS deadlines and dates that you need to know. Make sure and stay on top of all your personal and business filing dates and avoid needless penalties and interest with this valuable ebook.

How to Stop Wage Garnishments

If you’re suffering from and IRS or State wage garnishments, you know first hand how crippling this form of collection can be. Learn some inside tips for releasing these quickly and getting your accounts back into the green.

Understanding IRS Penalties

When you owe the IRS back taxes, they will begin to charge penalties and interest at an alarming rate, and the amount owed can spiral out of control quickly. Learn what you’re being charged and why to take better control of your issue.

5 Ways to Avoid an Audit

Anyone on the other side of an IRS examination and audit can attest first hand how tough these issues can be to navigate. Learn some tips and tricks for avoiding an audit altogether in this free and powerful download.

Foreign Banking 101 (FBAR/OVDI)

If you’ve had an overseas bank account with more than $10,000 in it, and it’s gone unreported to the IRS, this is one download you need to read! Learn what you need to be aware of to avoid criminal charges and hefty fines.

Get to know

From our help desk to yours

Two of the most powerful tools we use in the fight against tax debt are the 8821 and 2848 forms. Together, they allow us to begin the tax resolution process and empower us to represent your interests before the IRS. For many, signing a power of attorney form is a new experience, and the process can be intimidating. So here they are for your review. And of course if you have any questions, we’re here to help!

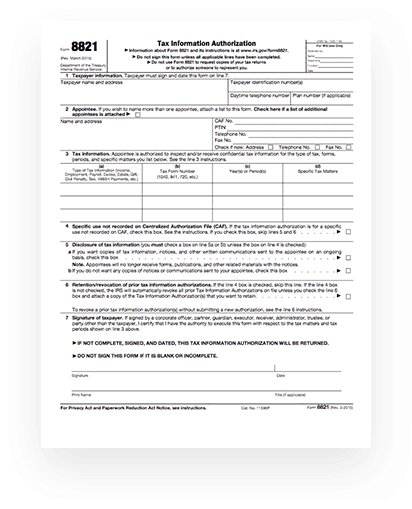

Form 8821: Tax Information Authorization

This form is the first step in representation, and allows us to order your master tax file from the IRS. This is very important as it gives us the opportunity to review your file for errors and to accurately determine the best tax relief solution to apply.

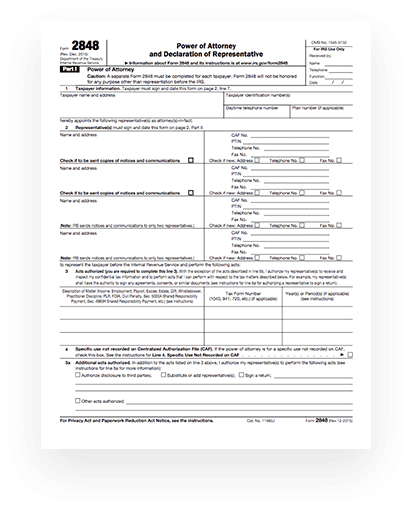

Form 2848: Power of Attorney

The 2848 is a limited IRS power of attorney form, providing us authority to represent your interests directly with either the IRS or state collection authorities. This is not an estate power of attorney form, it is only used for tax purposes. Much like an attorney representing you in a courtroom, this allows your assigned attorney or tax relief professional to speak on your behalf with either revenue officers or IRS agents, and is a very powerful tool in the tax relief process.