Audit Defense

at your service

Representing yourself in an IRS audit can cost you thousands of dollars in irreversible penalties!

When the IRS shows up to the audit, they are familiar with all the laws and regulations allowable, and unless you’ve handled audit proceedings before, you are not. They know this, and will use it to their advantage. We can help put you on equal footing with the IRS to both defend and validate your audited return.

Build a winning defense

If you have been served notice of an audit, our team of tax attorneys and skilled negotiators will work with you to build a wining defense.

Our experience

Our audit specialists have spent years understanding the audit process, and are skilled in every aspect of appeals and proceedure.

Appeals

If we do not agree with the auditors decisions, we will then take to an appeals process and get answers.

From start to finish:

How it Works

The IRS is presented a power of attorney. Collections holds are then placed while we address the audit.

The IRS audit agent is contacted and a full report of IRS claims is ordered.

We review the report and investigate the items being questioned by the IRS.

Audit specialist work directly with you to obtain and create the necessary documents for your defense.

All findings are then prepared and presented to the IRS along with a request for necessary adjustments.

Once the audit is successfully closed, we represent the client before the IRS if there are any balances remaining.

Any balances due are placed on an affordable repayment schedule and the audit is concluded.

A Winning Strategy

Our audit specialists have spent years understanding the audit process, and are skilled in every aspect of appeals and procedure to ensure a fair, just and winning outcome.

Free eBook

5 ways to avoid

an audit

Anyone on the other side of an IRS examination and audit can attest first hand how tough these issues can be to navigate. Learn some tips and tricks for avoiding an audit altogether in this free and powerful download.

Answers to questions

about audit services

-

Have an audit and can’t locate the records?

+We can go back as far as ten years and rebuild your books from the ground up, keeping you current, compliant and penalty free.

-

How does the IRS select who will be audited?

+The IRS has numerous reasons to select an individual or business to be audited. It varies from Computer scoring of your returns, information matching large corporations etc.

-

Should I have representation for an audit?

+Although it is not required it is strongly suggested. Our legal team is experienced in representing taxpayers in the audit process and getting the best results possible. We are able to organize the requested documents, reconcile receipts etc to create a complete packet to provide to the examiner.

-

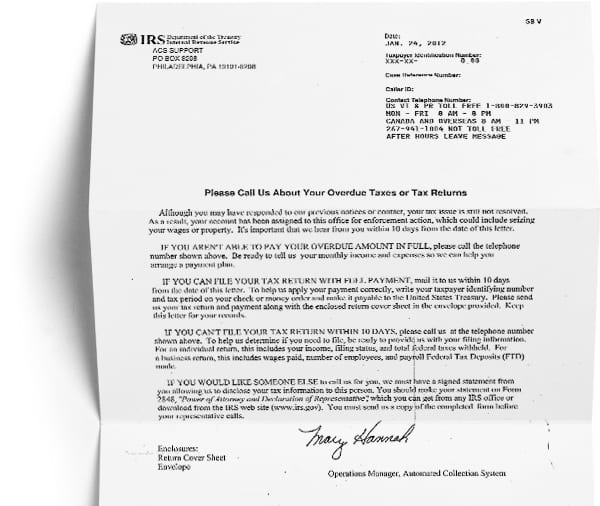

How am I notified that I am being audited?

+You will receive a notice from the Internal Revenue Service by mail. The IRS does not initiate audits via phone. If you are receiving phone calls at random mentioning an audit BEWARE: it may be a scam.

-

What can I do if I do not agree with the changes to my return?

+Taxpayers who do not agree with the proposed changes may appeal their case administratively within the IRS, to the U.S. Tax Court. We can assist you even after an unfavorable ruling of your audit through the appeals process.

-

Can the IRS audit me at random?

+Absolutely. The IRS has the right to audit any return they determine is incorrect.