- browse by category

- Audit Assistance

- Business and Taxes

- Celebrities in Tax Debt

- Cryptocurrency Taxes

- Economic News

- Foreign Banking

- Innocent Spouse

- IRS debt settlement

- IRS Headlines

- IRS Wage Garnishment

- Marriage & Divorce

- Payroll Tax

- Retirement

- Revenue Officers

- State Tax Headlines

- Stop IRS Debt

- Success Stories

- Tax and Politics

- Tax Attorney

- Tax Codes

- Tax Debt Help

- Tax Evasion

- Tax Levy

- Tax Lien

- Tax Payment Plans

- Tax Return Filing

- Tax Tips

After nearly two decades fighting on behalf of our tax debt relief clients, we know this much to be certain: Tax debt is serious business.

Tax debt has ruined the best-laid financial plans for millions of hardworking taxpayers in the United States. It’s lost people their homes, caused bankruptcies, and led to more headaches and heartaches than we’d like to know.

We’ve seen the best and worst of tax debt. Our diverse clients number in the thousands. They’ve hailed from sea to shining sea, ranged from low to high incomes, and have dealt with serious tax issues ranging from tax audits to unfiled tax returns, and situations as severe as millions of dollars in IRS tax debt.

Tax debt relief is a crucial component of achieving financial freedom from the IRS.

At StopIRSDebt.com, we don’t believe you should go it alone. That’s why we wanted to give you a top-to-bottom rundown of tax debt relief. We’re going to walk you through the ABCs of tax relief, from why you need it to how it works. We’ll also answer some tax debt relief FAQs so you know exactly what to expect at every step of the tax relief process.

Tax Debt: A Huge Problem for Americans

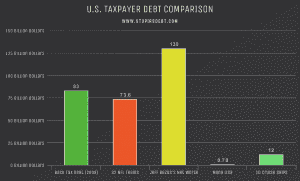

Tax debt is a serious issue for Americans. How big of an issue, you may ask? Well, back in 2009, an IRS spokesperson suggested that around 8.2 million American taxpayers owed more than $83 billion in back taxes. That’s over $10,000 per taxpayer!

Want to see what that looks like? Here’s a few comparisons for reference.

- The average value of a NFL team is $2.3 billion. With $83 billion, you could buy all 32 NFL teams and still have nearly $10 billion to spare.

- Jeff Bezos is the world’s richest person, with a net worth of $130 billion (as of 2020). The tax debt of all American taxpayers (back in 2009!) is nearly 2/3 that total.

- The estimate cost of the Mona Lisa is $780 million. With $83 billion, you could buy the Mona Lisa—with over $82 billion to spare.

- Your very own cruise ship would cost about $1.2 billion. You could buy 10 cruise ships and you wouldn’t even spend 15% of $83 billion.

Main Causes of Tax Debt

Even responsible taxpayers aren’t immune to ending up with a tax bill at some point in their lives. Here are just a few causes of tax debt that can spiral out of control.

- Surprise Tax Bill – When you don’t see a tax bill coming, it can be hard to plan for it. Sometimes taxpayers discover at the last minute that they owe the IRS money, but they can’t pay the total at the deadline. This can lead to accrued penalties and

- Tax Evasion – Sometimes, taxpayers purposefully hide their income from the IRS. But few are successful for that long. When the IRS does find you out, you’ll be on the hook for your tax bill—and possibly worse.

- Late or Unfiled Tax Returns – When you haven’t filed your tax return on time (or at all), the IRS will generally estimate your tax obligation. At some point, the IRS may send you a letter outlining their estimate of your tax debt total, which could spell trouble.

- Penalties and Fees – Many serious tax debts start small but snowball out of control. Depending on your specific tax total and how long you leave it unpaid, you might accrue a number of penalties and fees that will add up over time.

This video from the IRS explains the exact dynamic at play that can transform minor tax debts (think $100 or $500) into serious tax debt.

Your tax debt can get away from you faster than you think, and before you know it, you may just be in desperate need of tax debt relief.

Consequences of Having Tax Debt

The consequences of having tax debt can vary severely based on a number of factors: how much you owe, how long you’ve owed it, whether or not you’ve filed back tax returns, whether you’ve been responsive to the IRS, and so on.

1. Tax Liens and Tax Levies

When you haven’t made any attempts to pay the IRS or defend your case, they begin looking for methods to get the money they believe you owe them. One of these methods is the tax lien. Tax liens work a lot like the liens that banks place on your car or home when you take out a loan, which give the bank the right to repossess that piece of property if you fail to make payments.

Tax liens don’t automatically mean your home or the government will take your home or car; you’ll have time to make payments and get things squared away. But if you don’t, the IRS will can legally levy—or possess—your assets to pay your tax debt.

2. Lowered Tax Credit Score

When a tax lien hits your credit report, it can seriously harm your credit score because it’s an indication that you have a severe issue with paying your debts.

3. IRS Wage Garnishments

If you have failed to pay a tax debt, the IRS can garnish your wages to get their money. Through wage garnishment, the IRS siphons off a portion of your wages every paycheck in order to pay down your debt. This can put you and your family in a serious financial bind and is ultimately much worse of an outcome than just making regular monthly payments.

The Department of Labor protects employees from being terminated for having their wages garnished. However, those protections disappear if your earnings are garnished for a second or future debt.

4. Private Collections

In some situations, the IRS won’t want to keep putting time and energy into attempting to collect your tax debt; in those cases, they may field out your tax debt collection to a private collections firm. While the IRS will primarily contact you via mail, private collections may be more likely to call; all these calls and new pieces of mail can be overwhelming, stressful, and downright scary.

But don’t take our word for it. Here’s a little bit more from the Internal Revenue Service about the private collection of overdue taxes.

Warning: Watch out for scammers. Before a collection company contacts you, the IRS will have notified you by mail that your account has been assigned to a collection firm and that they can contact you about your debt. In this mail, you’ll be given information you can use to verify the veracity of the collection company. You should never be asked to pay via debit or credit card.

5. Passport or License Revocation

If you owe more than $52,000 in tax debt (including interest and penalties), the IRS may ground you by revoking your passport or preventing you from getting one. On top of that, certain state tax authorities have the right to revoke your driver’s license or other professional licenses.

How Tax Relief Works

Tax debt relief companies can help you navigate and get out of tax debt in a number of ways. Typically, tax relief companies will perform some combination of the following actions.

- Reviewing or filing old tax returns to lower a client’s debt.

- Taking over communication with the IRS to save the client from overwhelming communications.

- Helping negotiate payment agreements with the IRS.

- Avoiding or completely stopping penalties such as wage garnishments.

Tax Debt Relief FAQs

You’ve got questions about tax debt relief, and we’ve got answers. Here, we’re asking and answering some of the most common questions about tax relief so you can resolve your tax debt.

Are tax debt relief companies legitimate?

Yes, but not always. Unfortunately, not all tax debt relief companies have stellar reputations, and that has severely impacted how the general public views the entire tax debt relief industry. These companies view people with tax debt as money-making opportunities, and will sell them hard on the guarantee they can entirely eliminate their tax debt.

The reality is much more complicated than that, and any tax relief company worth your dollar will admit it. Your tax debt relief company shouldn’t be able to tell you—sight unseen—that they can entirely eliminate or substantially reduce your tax debt. A good tax debt company will work to understand every last detail about your tax liability, file your unfiled tax returns, determine the best methods for reducing your tax burden and helping you find opportunities for savings, and represent you in front of the IRS.

We’ve eliminated millions of dollars in tax debt for our clients. That’s because we view our tax debt clients as people, not as numbers. And whether or not you consider us for your tax relief solution, you deserve to be treated as a person.

How do I get tax relief from the IRS?

The first step to achieving tax relief from the IRS is to hire an expert tax relief company. We may be biased, but let us convince you.

Most taxpayers dealing with moderate to severe tax debt have never really dealt with the IRS before; in fact, most taxpayers barely interact with the IRS in any way outside of tax season. When you’re dealing with serious tax debt, though, that leaves you at a disadvantage when advocating for your tax case. On top of that, receiving visits from IRS representatives or getting mail from the IRS can scare just about anyone.

A reliable tax relief company will get to work for you in a couple of ways. First, they’ll step in on your behalf to accept all correspondence from the IRS. Next, they’ll get to the bottom of your tax case to understand your tax debt and plan a course of action to get you out from under it.

What is the Fresh Start program with the IRS?

Second, the Fresh Start program raised the tax debt totals required before taxpayers saddled with tax debt need to provide a financial statement to the IRS. This makes it a lot more convenient for people hoping to pay off their taxes over an extended period of time.

Finally, and most popularly, the Fresh Start program made helpful changes to the Offer in Compromise (OIC). We’ll dive into the OIC below, but essentially, the IRS may be willing to accept a total lower than your actual owed taxes if it believes that’s truly the best you can do. For some taxpayers, this can be a huge weight off and save you serious money, though it’s not the completely clean slate it’s made out to be by many tax relief companies. The Fresh Start program is incredibly useful, but just like anything else involved with tax debt relief, it’s not a magic wand!

What is an Offer in Compromise?

An offer in compromise, or OIC, gives you a chance to settle your tax debt for an amount lower than what you currently owe. This tax debt relief solution may be used when you can’t pay the full tax liability you owe, or when paying your full tax bill would create a financial hardship.

The IRS considers a handful of factors when deciding on your offer in compromise. These are the primary circumstances they’ll weigh:

- Ability to pay

- Income

- Expenses

- Asset equity

The IRS will generally accept an offer in compromise when it “represents the most we can expect to collect within a reasonable period of time.” This mostly means that the IRS isn’t trying to make you entirely destitute in order to collect their debt. That said, they want you to pay as fully as possible. They’ll weigh your financial situation holistically in order to ensure you’re contributing what you can.

To file an offer in compromise, you must be current on your filed tax returns and estimated payments. You also can’t be in an open bankruptcy proceeding to file an OIC. You can find more information on the offer in compromise here, which we recommend reading only after finishing this article in its entirety (since we may answer your other tax debt relief questions).

How can I get my tax debt forgiven?

Through advertising and marketing, many tax debt relief services imply they can convince the IRS to completely forgive your tax debt, or reduce your tax bill to $0. The least legitimate tax relief companies might even try to make you think they can turn $20,000 of tax debt into a tax refund!

These are misrepresentations with the express purpose of putting your hard-earned money in their pockets. Tax debt forgiveness is a much more complex process than it seems, and it usually involves a tax resolution firm trying a number of different avenues to reduce or eliminate your tax debt. For example, your income and assets may make you a perfect candidate for an offer in compromise, which could cut your tax debt in half. Or based on your tax filing history and the applicable tax deductions and tax credits, we might discover you don’t actually owe the IRS anything—eliminating your tax debt entirely.

Total tax debt forgiveness is rare, and it’s not as simple as it’s made out to be. But a trustworthy tax relief company will make every attempt to lower your tax bill and resolve your tax issues.

Questions to Ask a Tax Relief Company

Deciding on the right tax relief company can be a challenge. That’s because not every tax debt relief company will prioritize your tax case over their own bottom line. Here are a few questions you can and should ask any tax relief company before hiring them—and why.

1. “Do you guarantee that I can eliminate my tax debt completely?”

No tax debt relief company should guarantee they would completely eliminate your tax debt. If they do, it’s not honesty—it’s a sales tactic.

Legitimate tax debt relief companies can substantially lower your tax bill. They may file back tax returns while applying appropriate tax credits and deductions, file for an Offer in Compromise, or work to set up a reasonable payment plan that allows you to manageably pay down your debt. However, don’t be mistaken: Your tax debt situation is unique, and no approach to tax relief is one-size-fits-all.

If a tax relief company is claiming they can completely eliminate your tax debt without knowing the full story about your bill, they’re most likely just looking to get you to sign. In our opinion, these companies are unscrupulous and predatory—and they won’t advocate for you with the IRS as much as they’ll advocate for their own bottom line.

2. “Which types of tax professionals will be working on my tax relief case?”

No tax relief companies are exactly the same, and neither are their employees. That’s exactly why it’s good to have a sense for the types of tax specialists a tax resolution firm employs.

As an example, some tax relief companies are actually law firms that specialize in tax law. While that can be very useful, it may be better suited to certain tax cases than others—and it may also suggest you’ll pay more than you might need to in order to resolve your tax debt. StopIRSDebt.com is a tax resolution firm, not a law firm. Since we’re focused on mediating and resolving difficult tax liability issues before state tax authorities and the IRS, our team is comprised of a wide grouping of tax specialists. We employ tax attorneys, tax preparers, and enrolled agents.

While it’s not 100% imperative that your tax resolution team be comprised of any specific type of tax professional, understanding the types of tax specialists that are employed by a tax relief firm can be a big help. You can better understand where their priorities or price points may be, and you’ll at least get a sense for how forthright they are about the expertise at your disposal.

3. “How much do tax relief services cost?”

Tax debt relief services range in price based on a number of factors. But how a tax relief company structures their services and refunds can say a lot about them.

Whatever the tax problem you’re dealing with—wage garnishments, IRS levies, unfiled tax returns—your specific price may vary. But it will usually come down to a combination of a few factors. First, your total estimated tax debt will probably play a role; many tax companies will put maximum limits on the tax totals they’re willing to take on. Or, they may simply not be experienced in high tax debt totals (think $1 million and over). Other tax companies may set minimum tax totals they’re willing to take on, because it helps guarantee their bottom line.

A good tax relief company should acknowledge that prices should vary—to some extent—on a case-by-case basis. The solution for one person’s tax debt may be to file back tax returns, while another’s may be an OIC. The situation may also change if the IRS has placed a wage garnishment on a client! Tax debt relief services don’t exist in a vacuum.

The Secret Truth about Tax Relief

We can’t sugarcoat the answer to the question, “How can I get my tax debt forgiven?” In many cases, you can’t. Or at least, you can’t get it entirely forgiven.

Yes, you may find out you really can reduce your debt by thousands and thousands of dollars! Among thousands of other amazing success stories, we’ve helped our clients literally halve their tax debt, or reduce their total from $80,000 down to $0 in just a couple months. However, we’ve also seen more than our fair share of clients who may not qualify for many tax reductions and whose tax debt takes several years to resolve through an installment plan.

Just like tax debt doesn’t spring out of thin air, neither does tax relief. Tax debt relief can be a long process of regular payments and tightening the belt. It’s a complex, hard process—but it’s absolutely worth it. You owe it to yourself to get out from under those harassing letters and retake control of your financial life.

Tax Debt Relief: Everything You Need to Know

Tax debt relief can be a drawn out, frustrating, and complicated process, which is exactly why you need to be able to trust your tax relief company to have your best interests at heart. It takes a team of experts to make sure you get the absolute best results possible and to stick with you along the way.

The race to tax relief is a long one. But with the right information, support, and guidance, you can reach that finish line strong. And we’re always here to cheer you along the way.

Are you struggling with tax debt, a tax lien, IRS wage garnishments, or other serious tax issues? You don’t need to go it alone—we’re here to help. Send us a message today via our free live chat and get the help you and your family deserve.

Leave Comments

Top Tax

secrets revealed

Sign up for our newsletter and be the first to find out when exciting IRS news happens. Yes, exciting. We're really into taxes.